I believed that Brexit should not affect goods in custom... I read almost everywhere that no custom fees will be applied for continental Europe (and apparently it was one of the main negociation points).

Max, did you pay when you received the book or before Blackwell has shipped?

If there are such huge custom fees that's terrible news indeed and maybe means the end of collecting for me..

Max, did you pay when you received the book or before Blackwell has shipped?

If there are such huge custom fees that's terrible news indeed and maybe means the end of collecting for me..

VAT isn't a custom fee though. VAT is just a tax that should be (or not) applied to various purchases (in the UK). It was widely ignored by UK customs (stuff coming in) for most non-European shipping of small value before Brexit already.

For those importing UK goods (inc. books) to Europe you have to consider whether the price you're checking out at includes the taxes that you would pay in the country you're sending to. Your own tax laws. If taxes apply (VAT/equivalent) to whatever you're buying then the UK price probably doesn't include this. You'll need to pay this somewhere. And it's common practise at customs (in the UK anyway) to start adding on all sorts of other "processing" fees because you haven't paid this at point of checkout. This always happened in the UK too. These aren't real custom charges (as I understand it) just normal taxes you're deemed to have avoided and various other penalties for customs having to deal with this.

An example pre-Brexit is music digital downloads. These were never VAT exempt in the UK. But UK buyers were able to download music from anywhere without VAT being applied. Amazon and Bandcamp and other platforms closed down this loophole a few years back by checking IP addresses and adding VAT to UK buyers at checkout. None of this has anything to do with custom charges. It's just about buyers avoiding (through no fault of their own) paying the correct tax on items where tax is applicable.

For those importing UK goods (inc. books) to Europe you have to consider whether the price you're checking out at includes the taxes that you would pay in the country you're sending to. Your own tax laws. If taxes apply (VAT/equivalent) to whatever you're buying then the UK price probably doesn't include this. You'll need to pay this somewhere. And it's common practise at customs (in the UK anyway) to start adding on all sorts of other "processing" fees because you haven't paid this at point of checkout. This always happened in the UK too. These aren't real custom charges (as I understand it) just normal taxes you're deemed to have avoided and various other penalties for customs having to deal with this.

An example pre-Brexit is music digital downloads. These were never VAT exempt in the UK. But UK buyers were able to download music from anywhere without VAT being applied. Amazon and Bandcamp and other platforms closed down this loophole a few years back by checking IP addresses and adding VAT to UK buyers at checkout. None of this has anything to do with custom charges. It's just about buyers avoiding (through no fault of their own) paying the correct tax on items where tax is applicable.

Khamûl wrote:

I suppose you can only really look at your own country & what the rules are about exporting in from a so-called third country. With VAT in the UK the issue is, I believe, that the UK thinks sellers will register to set up collecting the VAT at their (country of origin) end for the UK. Which is basically nonsense. Foreign sellers have never previously done this e.g. US sellers. And, with books, this is because the custom declaration should (honestly) state "books", and most printed matter incurs 0% VAT. So these sellers will be potentially charging (the buyer), collecting, and paying (to UK authorities) VAT on non-applicable items. Unless of course VAT on books has changed I have no clue what I'm talking about...

This is sort of the NZ system. If a seller does more than NZD 50K of business with NZ customers annually, then they are required to collect and remit NZ GST to the NZ tax office. The big sellers (Amazon, eBay, etc all now do this). Smaller/Non big-name sellers just ignore it. As part of implementing this system, we increased the tax free threshold for stuff coming from non-registered sellers to $1000, so overall it probably ended up as a wash.

The UK was pretty much ignoring everything under £15 (custom declared) in terms of assessing for VAT etc. Anything over that they were slapping on VAT to total value and charging you a £10 customs processing fee. Books only ever got caught up in this if the custoums declaration that the seller fills out was incorrect.

I already see the difference since the 1st january, the import fees are huge but if you do business with an individual you can bypass the tax by asking the seller to send you the package, specifying that it is a gift. Here is some explanation from the uk gouv.

Gifts

To qualify as gifts, goods must be:

described as gifts on the customs declaration for a birthday, anniversary or other occasion bought and sent between individuals (not companies)intended for personal use.

Gifts

To qualify as gifts, goods must be:

described as gifts on the customs declaration for a birthday, anniversary or other occasion bought and sent between individuals (not companies)intended for personal use.

https://www.gov.uk/government/publicat ... -international-post-users

2.4 Gifts

Goods sent as a gift that are over £39 in value are liable to Import VAT. Customs Duty also becomes payable if the value of the goods is over £135.

Emilien wrote:

I believed that Brexit should not affect goods in custom... I read almost everywhere that no custom fees will be applied for continental Europe (and apparently it was one of the main negociation points).

Max, did you pay when you received the book or before Blackwell has shipped?

If there are such huge custom fees that's terrible news indeed and maybe means the end of collecting for me..

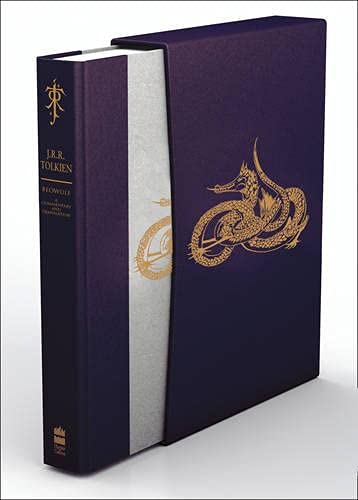

DHL wrote me saying they payed taxes for me in advance and I should pay before having the book delivered.

I payed DHL and I had to print the receipt to hand to the courier. Funny I was writing this post and DHL just rang the door.

Kinda shocked I had to pay almost 50% of taxes, I will buy way less in the future.

Thank you for your explanations Khamûl

Max : Understood. Sorry that you have to pay 50% of the value in taxes :(

That means for me it will be quite complicated for receiving new books bought on Blackwell or other online retail stores.

I don't have letter box at my building, and my house keeper doesnt' hold parcels for us, only simple letters... So I use to make my parcels delivered at my work place which is a big institution. There is a delivery bay there so I don't collect the parcels myself : some people working at this delivery bay do it and then redirect mail to the different divisions. That means I can't even pay taxes to the courier in hand. Which means difficult times regarding my future collecting.

Regarding second hand books bought on ebay or elsewhere, it might be different. I have just received a £15 book bought on ebay this morning (Smith of Wooton Major Extended Edition, edited by Verlyn Flieger), and it was delivered without any issue (no taxes, maybe because of the low value). I'm waiting for another one bought from ebay with a higher value (£70) : will see how it goes...

Max : Understood. Sorry that you have to pay 50% of the value in taxes :(

That means for me it will be quite complicated for receiving new books bought on Blackwell or other online retail stores.

I don't have letter box at my building, and my house keeper doesnt' hold parcels for us, only simple letters... So I use to make my parcels delivered at my work place which is a big institution. There is a delivery bay there so I don't collect the parcels myself : some people working at this delivery bay do it and then redirect mail to the different divisions. That means I can't even pay taxes to the courier in hand. Which means difficult times regarding my future collecting.

Regarding second hand books bought on ebay or elsewhere, it might be different. I have just received a £15 book bought on ebay this morning (Smith of Wooton Major Extended Edition, edited by Verlyn Flieger), and it was delivered without any issue (no taxes, maybe because of the low value). I'm waiting for another one bought from ebay with a higher value (£70) : will see how it goes...

Emilien wrote:

That means I can't even pay taxes to the courier in hand. Which means difficult times regarding my future collecting.

You could get a PO box, then the PO Box company pay the tax and you pay them to get the item.

It would be nice if all the EU states had the same policy on physical books as the UK has, that they are 0% Tax.

Trotter wrote:

Emilien wrote:

That means I can't even pay taxes to the courier in hand. Which means difficult times regarding my future collecting.

You could get a PO box, then the PO Box company pay the tax and you pay them to get the item.

It would be nice if all the EU states had the same policy on physical books as the UK has, that they are 0% Tax.

Unfortunately the French post doesn't offer that service. All parcels sent from UK with Royal Mail are took over by the French post.

For DHL, GLS, Fedex etc, I might ask for parcels to be delivered at their local agencies in Paris, that's for sure. Need to do a survey for each company and ask sellers to use the proper courier afterward..

4356

4356 1.98M

1.98M